💰 Mortgage Calculator Tool

Calculate your monthly mortgage payments with precision and ease

Your Mortgage Summary

7 Smart Reasons to Use a Mortgage Calculator Tool in 2025

Planning to buy a home in 2025? Understanding your financial commitment is crucial before signing any mortgage agreement. A mortgage calculator tool empowers homebuyers with instant insights into monthly payments, total interest costs, and loan affordability. Whether you’re a first-time buyer or refinancing your existing home, this comprehensive guide reveals why every homebuyer needs this essential financial planning resource.

📋 Table of Contents

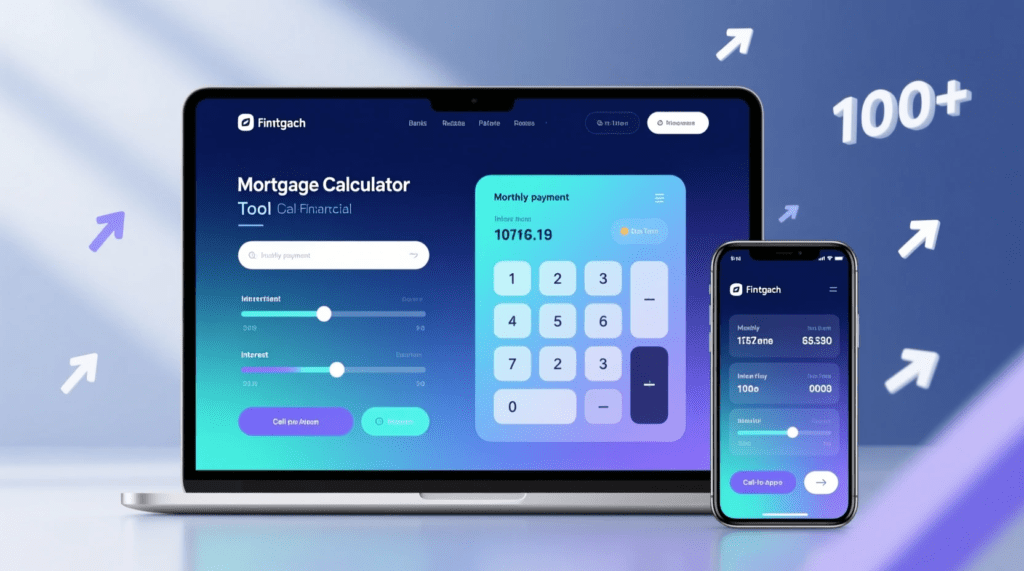

What is a Mortgage Calculator Tool?

A mortgage calculator tool is an online financial instrument designed to estimate your monthly mortgage payments based on key variables including home price, down payment, interest rate, and loan term. This digital solution eliminates guesswork and provides accurate projections that help you make informed homebuying decisions.

Unlike traditional manual calculations that require complex mathematical formulas, modern mortgage calculator tools deliver instant results with user-friendly interfaces. These calculators factor in principal amounts, interest rates, and loan duration to present a comprehensive financial breakdown of your potential mortgage commitment.

Key Components of a Mortgage Calculator

- Home Price: The total purchase price of the property

- Down Payment: Initial payment (typically 3-20% of home price)

- Loan Term: Duration of the mortgage (commonly 15 or 30 years)

- Interest Rate: Annual percentage rate charged by the lender

- Monthly Payment: Your recurring mortgage obligation

How Does a Mortgage Calculator Tool Work?

The mortgage calculator tool operates using the standard mortgage payment formula that factors in principal, interest rate, and time period. Here’s the mathematical foundation behind your calculations:

The formula used is: M = P[r(1+r)^n]/[(1+r)^n-1]

Where:

- M = Monthly mortgage payment

- P = Principal loan amount (home price minus down payment)

- r = Monthly interest rate (annual rate divided by 12)

- n = Number of monthly payments (loan term in years × 12)

Modern calculators automate this complex calculation, instantly adjusting results as you modify input values. This real-time functionality allows you to experiment with different scenarios and understand how each variable impacts your monthly payment obligation.

7 Smart Reasons to Use a Mortgage Calculator Tool

1. Instant Financial Clarity

The primary advantage of using a mortgage calculator tool is immediate access to accurate payment projections. Rather than waiting for lender quotes or struggling with manual calculations, you receive instant results that clarify your financial commitment. This transparency empowers you to evaluate affordability before contacting lenders or viewing properties.

2. Budget Planning Precision

Effective budgeting requires understanding your monthly housing expenses. A mortgage calculator tool reveals exactly how much you’ll pay each month, allowing you to assess whether this fits comfortably within your budget. You can adjust variables like down payment amounts or loan terms to find the sweet spot that balances affordability with homeownership goals.

3. Compare Multiple Loan Scenarios

Should you choose a 15-year or 30-year mortgage? How much does a 1% interest rate difference actually cost? The mortgage calculator tool enables side-by-side comparisons of different loan structures. This comparative analysis reveals long-term cost differences and helps you select the most advantageous mortgage option.

4. Down Payment Strategy Optimization

Your down payment significantly impacts both monthly payments and total interest paid. Using a mortgage calculator tool, you can visualize how increasing your down payment reduces monthly obligations and saves thousands in interest over the loan’s lifetime. This insight helps you determine the optimal down payment amount for your financial situation.

5. Interest Rate Impact Awareness

Even small interest rate variations dramatically affect mortgage costs. A mortgage calculator tool demonstrates exactly how rate changes influence your monthly payment and total interest expense. This awareness is invaluable when negotiating with lenders or deciding whether to buy now or wait for better rates.

6. Refinancing Decision Support

Homeowners considering refinancing can use mortgage calculator tools to evaluate potential savings. By comparing your current mortgage against refinancing options with different rates or terms, you can determine whether refinancing makes financial sense after accounting for closing costs and fees.

7. Pre-Approval Preparation

Before applying for mortgage pre-approval, a mortgage calculator tool helps you establish realistic expectations about affordable price ranges. This preparation ensures you target homes within your budget and presents you as a serious, informed buyer to sellers and real estate agents. Learn more about mortgage preparation strategies at Quick Tooler Hub.

How to Maximize Your Mortgage Calculator Tool

Getting the most value from your mortgage calculator tool requires strategic usage. Follow these best practices to extract maximum insights:

Input Accurate Information

Calculator accuracy depends entirely on input quality. Research current interest rates from multiple lenders, determine realistic down payment amounts based on your savings, and consider property taxes and insurance costs that affect overall housing expenses.

Test Multiple Scenarios

Don’t settle for a single calculation. Experiment with various combinations of down payments, loan terms, and interest rates. Create a spreadsheet comparing different scenarios to identify the optimal balance between monthly affordability and long-term costs.

Factor in Additional Costs

Remember that your mortgage payment represents just one component of homeownership expenses. Consider property taxes, homeowners insurance, HOA fees, maintenance costs, and potential PMI (private mortgage insurance) when evaluating true affordability.

Regular Recalculation

Interest rates and housing markets fluctuate constantly. Revisit your mortgage calculator tool regularly to stay informed about changing market conditions and adjust your homebuying strategy accordingly.

Choosing the Right Mortgage Calculator Tool

Not all mortgage calculators offer equal functionality. When selecting a mortgage calculator tool, prioritize these essential features:

- User-Friendly Interface: Intuitive design with clear labels and easy navigation

- Comprehensive Inputs: Options for various loan types, terms, and down payment scenarios

- Detailed Results: Breakdown showing principal, interest, and total costs

- Mobile Responsiveness: Seamless functionality across all devices

- Data Export Options: Ability to save or download calculation results

- No Registration Required: Immediate access without mandatory account creation

- Regular Updates: Current data reflecting latest lending standards

The calculator featured on this page incorporates all these elements, providing a premium experience with professional-grade accuracy and stunning visual design. For additional financial planning resources, visit Pin Trust.

Common Mistakes When Using Mortgage Calculators

Avoid these frequent errors that compromise the effectiveness of your mortgage calculator tool:

Overlooking Additional Expenses

Many users focus solely on principal and interest while forgetting about property taxes, insurance, and maintenance. These costs can add hundreds to your monthly housing expenses and significantly impact affordability.

Ignoring Credit Score Impact

Your credit score directly influences the interest rate lenders offer. Calculators use average rates, but your actual rate may vary substantially based on creditworthiness. Check your credit score before making purchasing decisions.

Forgetting About Closing Costs

Closing costs typically range from 2-5% of the purchase price. While not part of monthly payments, these upfront expenses require significant cash reserves that affect your down payment capacity and overall budget.

Assuming Static Interest Rates

If considering an adjustable-rate mortgage (ARM), remember that rates change over time. A mortgage calculator tool shows initial payments, but ARM rates typically adjust after fixed periods, potentially increasing monthly obligations.

❓ Frequently Asked Questions

Final Thoughts: Your Path to Informed Homebuying

A mortgage calculator tool transforms the complex homebuying process into a manageable, data-driven journey. By providing instant insights into monthly payments, total costs, and various loan scenarios, these calculators empower you to make confident financial decisions aligned with your long-term goals.

Whether you’re exploring homeownership possibilities, comparing loan options, or preparing for mortgage pre-approval, regular use of a mortgage calculator tool ensures you enter negotiations informed and prepared. The calculator featured above offers professional-grade accuracy with an elegant, user-friendly interface designed specifically for 2025 homebuyers.

Remember that while mortgage calculator tools provide excellent estimates, they represent starting points rather than final answers. Consult with qualified mortgage professionals, explore multiple lending options, and thoroughly review all loan documents before making final commitments. Your dream home awaits—start your journey with accurate financial planning today.

Ready to explore your mortgage options? Use the calculator above to discover your potential monthly payments, experiment with different scenarios, and download your personalized results. Your path to homeownership begins with informed financial planning.